Our new workplace pension has arrived – now available to all new employers.

Get an auto enrolment ready workplace pension with easy online admin, sustainable investments, and a mobile app.

The following information is required for the pension contribution upload file:

| Column | Field Content | Data Type (max characters) | Example |

| A* | NINO | Alphanumeric (9) | XX111111X |

| B | Employee Name (this field will not be validated and is purely for information purposes) | Alphanumeric (200) | Peter Wilson |

| C* | Date PRP Start | Date (dd/mm/yyyy) | 03/10/2020 |

| D* | Date PRP End | Date (dd/mm/yyyy) | 09/10/2020 |

| E* | Salary for PRP | Numeric (5,2) | 00000.00 |

| F | Employer Pension Contribution (including Salary Sacrifice Contribution, if applicable) | Numeric (5,2) | 00000.00 |

| G | Employee Pension Contribution | Numeric (5,2) | 00000.00 |

| H | Group Life Assurance (if applicable) | Numeric (5,2) | 00000.00 |

| I | Employer Lump Sum (if required) | Numeric (5,2) | 00000.00 |

| J | Employee Lump Sum (if required) | Numeric (5,2) | 00000.00 |

| K | Column no longer used | Blank | Blank |

*Mandatory fields

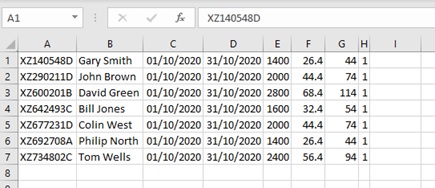

Example - weekly paid employees

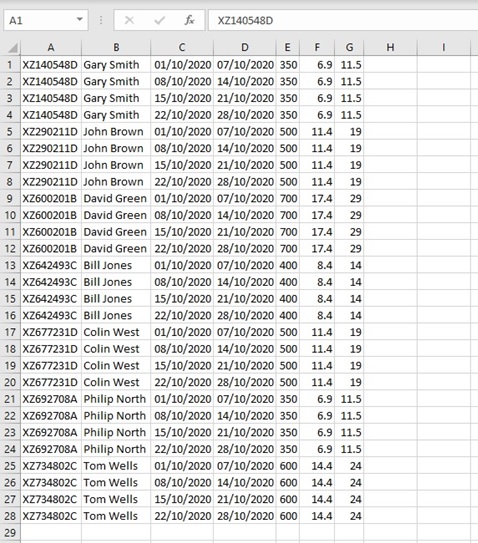

Example - monthly paid employees

NB When saving the file, it must be saved as the file type CSV (Comma delimited).

The file should contain no titles or totals. If employees are paid weekly, then each week’s contributions should be shown (see example above).

This information should be extracted from your payroll software. Please refer to your payroll software guidance for information on how to do this.

Once extracted, the information should be arranged in the same column order as in the table above.

Group Life Assurance

If the company does not use Group Life Assurance, then leave Column H blank.

If your company does use Group Life Assurance, column H should have the Group Life Assurance Contribution Value for that employee within that Payment Reference Period.

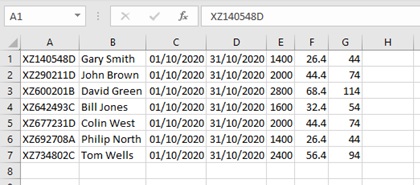

Example - monthly paid employees with Group Life Assurance