Our new workplace pension has arrived – now available to all new employers.

Get an auto enrolment ready workplace pension with easy online admin, sustainable investments, and a mobile app.

The following information is required for the pension contribution upload file:

| Column | Field Content | Data Type (max characters) | Example |

| A* | NINO | Alphanumeric (9) | XX111111X |

| B | Employee Name (this field will not be validated and is purely for information purposes) | Alphanumeric (200) | Peter Wilson |

| C* | Date PRP Start | Date (dd/MM/yyyy) | 01/10/2020 |

| D* | Date PRP End | Date (dd/MM/yyyy) | 31/10/2020 |

| E* | Salary for PRP | Numeric (5,2) | 1400.00 |

| F | Employer Pension Contribution (including Salary Sacrifice Contribution, if applicable) | Numeric (5,2) | 70.40 |

| G | Employee Pension Contribution | Blank | |

| H | Group Life Assurance (if applicable) | Numeric (5,2) | 00000.00 |

| I | Employer Lump Sum (if required) | Numeric (5,2) | 00000.00 |

| J | Employee Lump Sum (if required) | Numeric (5,2) | 00000.00 |

| K | Column no longer used | Blank | Blank |

*Mandatory Fields

NB When saving the file, it must be saved with the type CSV (Comma delimited).

The file should contain no titles or totals. If employees are paid weekly, then each week’s contributions should be shown (see example above).

If your company uses Salary Sacrifice instead of employee contributions, all contributions should be entered into column F. Column G should be blank.

This information should be extracted from your payroll software. Please refer to your payroll software guidance for information on how to do this.

Once extracted, the information should be arranged in the same column order as in the table above.

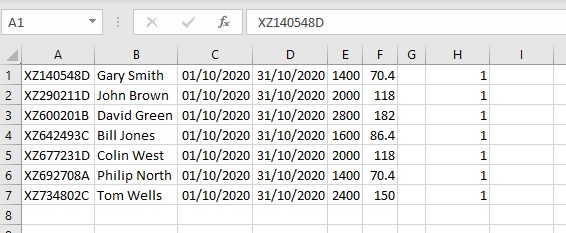

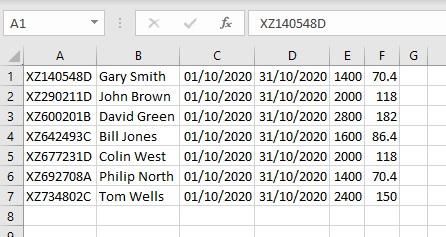

Example

Contribution file format if using Group Life Assurance

If your company also uses Group Life Assurance, column F should be completed as appropriate, column G should be blank and column H should be completed with the premium amounts.

Example